As we barrel towards the start of a new decade, it’s amazing to think about the ongoing transformation within real estate.

In the U.S., housing’s contribution to our GDP is ~15-18% spread across residential transactions, construction and housing services (i.e. rent, utilities, insurance, etc.) For the average homeowner, their primary residence is the biggest component of their net worth. And for employers, affordable housing programs can increase employee retention, productivity and success on the job. Apple, Google and Facebook have all launched different programs focused on addressing the high cost of living, particularly in the San Francisco Bay Area.

Technology has allowed for some real progress

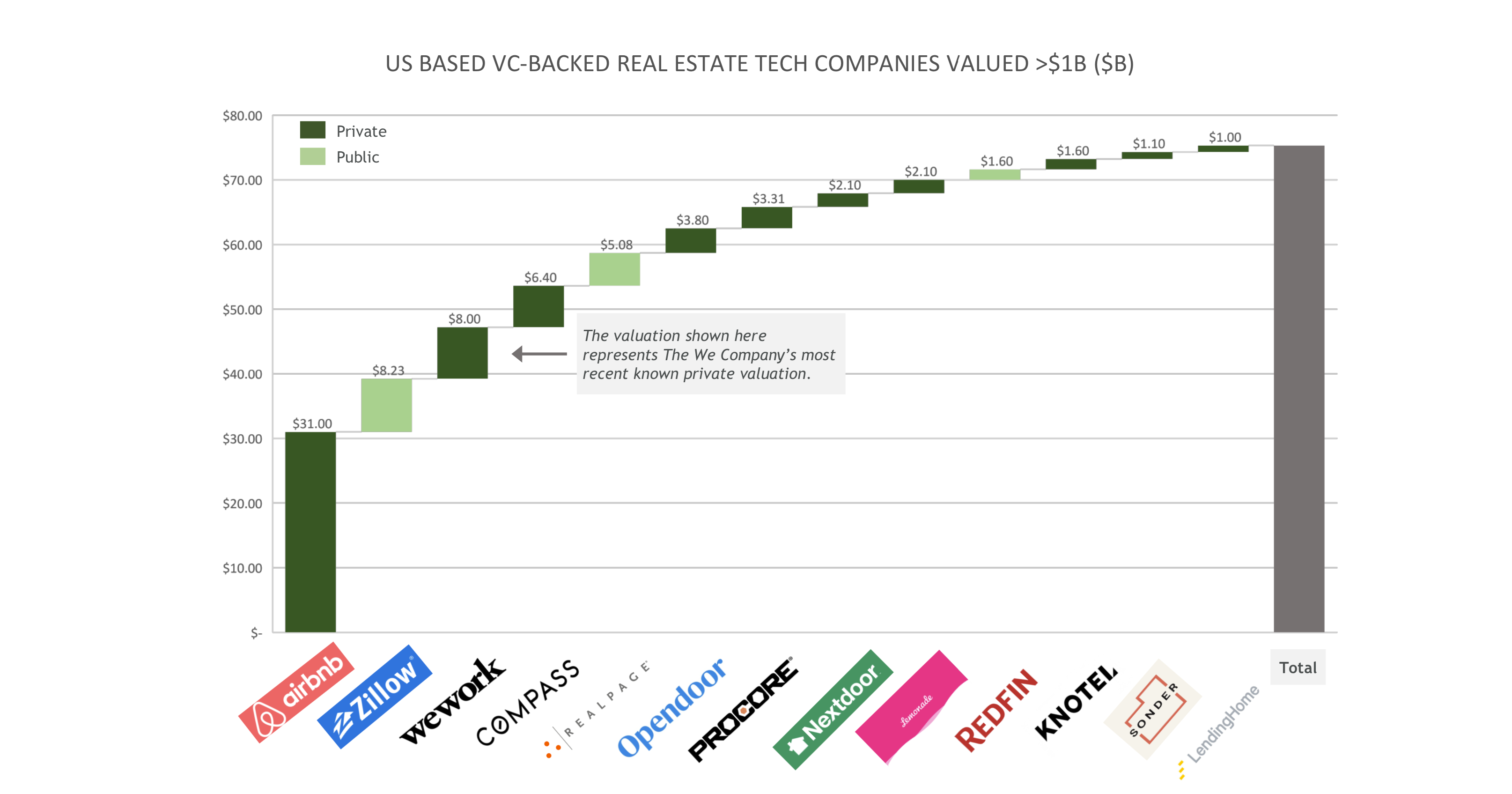

Technology has accelerated the rate of progress within the real estate vertical. There are now more than a dozen real estate tech companies valued at an aggregate ~$75 billion (depending on where The We Company lands in the coming months). This batch includes three publicly-traded companies (Zillow, Real Page and Redfin), two others primed to go public in the next year (Airbnb and Procore) and one other that recently put its IPO plans on hold (Lemonade).

New entrants have succeeded by bringing a fresh take to the category and/or creating entirely new categories. Airbnb, WeWork, Knotel and Sonder have all used the “monetize underutilized assets” playbook — applied in either residential or commercial settings. Compass and Redfin are re-imagining what it means to be a modern, tech-enabled brokerage firm. Realpage and Procore are bringing application software solutions to property management and construction. Lemonade and LendingHome are more traditional fintech companies applied to the real estate transaction ecosystem.

Significant opportunities remain

Over the coming decade, we at Oak HC/FT expect more innovation to come within real estate as we anticipate a continued influx of talent into the sector. And we think the total market cap of real estate tech companies could more than double to $200 billion in aggregate value by 2030. Here are some of the innovations and companies we are watching in 2020 and beyond:

- More value for buyers and sellers: Zillow brought much needed transparency into what was “on the market” (i.e. the top of the funnel). But the home transaction process is still convoluted and prohibitively expensive. In recent years, there has been a wave of new entrants focused on improving the transaction process in different ways, each with a slightly different approach. The iBuyers, like Opendoor and Offerpad, allow for sellers to sell instantly. Flyhomes allows buyers to put down cash offers. ZeroDown and Divvy lower the barrier to entry to buying a home. And Homie brings assembly-line specialization and vertical integration to drive down agent commissions. In the coming years there will be multiple wins here, with each appealing to different segments of this massive market.

- Better tools for ecosystem players: Agents and other providers are itching for better software tools to do their jobs. Side provides agents with all the tools they need (across marketing, vendor management, legal, insurance and transaction coordination) to run their own business — rather than relying on the incumbent brokerages with their hefty fees. Qualia, Spruce and Modus provide next generation title and escrow services. Great Jones, TenantCloud, Avail and Mynd help landlords better manage their properties.

- Increased access to data: The availability of data for decision making, especially on the commercial side, is still very much underdeveloped. Crexi has brought a Zillow-like experience to listing commercial properties. Reonomy has made nice progress using machine learning to surface key financial and asset-level data on commercial properties. We expect these and other new entrants to win big by bringing more transparency to commercial real estate.

- Greater flexibility in how we work and live: As the demands of modern life have changed, so too have the ways in which consumers desire to work and live. The Wing and HubHaus provide communities that appeal to more targeted groups. Feather allows its customers to rent furniture wherever they live or work. And prefab housing companies, including Dvele, enable consumers to design their home before moving in.

No comments:

Post a Comment