At some point, cryptocurrency will replace fiat currency. The tides of cryptocurrency may appear to have stalled, but the truth is that we’re still only at the beginning. Like, the very beginning.

The astronomical rise of Bitcoin and Ethereum throughout 2017 into early 2018 skewed markets—and as markets plunged south, so did wider public opinion.

But that doesn’t change the underlying technology or future prospects of cryptocurrency as a whole. Indeed, cryptocurrencies will soon be ready to take over fiat currency. Here’s why.

Cryptocurrency vs. Fiat Currency, Compared

Fungible: Each unit of currency must be exactly the same and interchangeable. A dollar is a dollar, and a cent is a cent. The same applies to Bitcoin, Ethereum, and all other cryptocurrencies.

Durable: Gold would be pointless if it dissolved in the rain or melted at room temperature. Even paper currency is durable to a point, with many countries using or introducing polymer bank notes. Cryptocurrencies are entirely digital, with data stored on a decentralized network. Other than by losing access to your digital wallet, cryptocurrencies are extremely durable.

Scarce: Currency is scarce; rather, it has a limited supply. Following the 2008 global financial crisis, we saw that governments could create more currency whenever they want, but the point still stands. Cryptocurrency, on the other hand, has limitations that differ from coin to coin. There are only 21 million total Bitcoins, for example, while other cryptocurrencies may have an infinite supply.

Divisible: Currencies must break down into smaller units. Dollars into cents. Bitcoins into satoshis. (What is a satoshi?) Theoretically, Bitcoin can break down into infinitely smaller units, depending on the value of a single bitcoin.

Trade: The main purpose of currency is to facilitate the exchange of goods and services. Some cryptocurrencies lag behind fiat currency here because transactions take too long to verify. Regardless, you can use cryptocurrencies to purchase a wide range of goods and services, just as you can with fiat.

Cryptocurrencies tick all the boxes when you compare all the different functions and aspects of fiat currency.

Why Cryptocurrency Will Replace Fiat Currency

1. Decentralized and Fairer Financial Systems

Elite financiers, bankers, business magnates—an elite few directly control the currencies on which the rest of us depend. Regular folks like you and me can’t influence the market, and even when thousands of people band together, nothing really changes.

A core part of that control relates to supply. When the supply increases, money decreases in value, and vice versa. Those in the driving seat can profit from such sudden changes in financial markets. Decentralization takes global financial control from the elite few and restores it to the masses.

It’s important to note that the cryptocurrencies most likely to prosper as fiat replacements have a limited supply. Furthermore, cryptocurrencies that aren’t directly tied to any governments won’t suddenly be devalued because of the actions of one controlling group. (That doesn’t mean cryptocurrencies can’t be devalued through other means.)

Ultimately, decentralization means less manipulation. Not completely eradicated, but definitely reduced to a much smaller level of influence. Cryptocurrencies aren’t subject to inflation, interest rates, cross-border exchange rates, business taxes, and so on.

2. Cryptocurrency Adoption Is on the Rise

It’s impossible to find figures that accurately show how many cryptocurrency users there are. Some people use multiple wallets, across multiple platforms, for a variety of coins. Furthermore, many users and crypto-exchanges use new wallets for each incoming and outgoing transaction, which artificially balloons figures.

However, there are a few charts that track the steady growth of cryptocurrency markets around the globe.

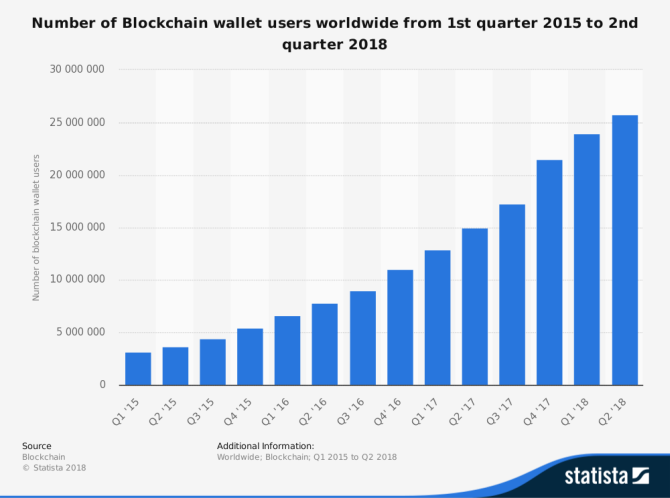

First up, check out Statista’s chart of “Number of Blockchain wallet users worldwide from 1Q 2015 to 2Q 2018.” It shows a steady increase in the number of Blockchain wallet users, reaching over 25 million users in Q2 2018.

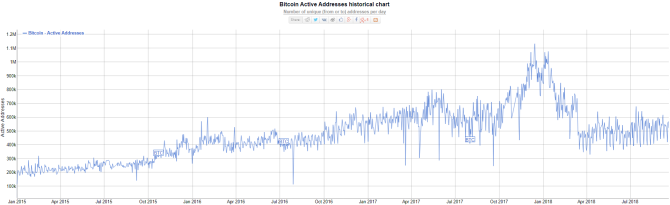

For more perspective, here’s a chart that shows the daily number of active Bitcoin addresses over the same period. Understandably, the chart peaks (1.13 million active addresses) at the same time that Bitcoin’s price peaks, but also reflects the overall growth in Blockchain wallet accounts:

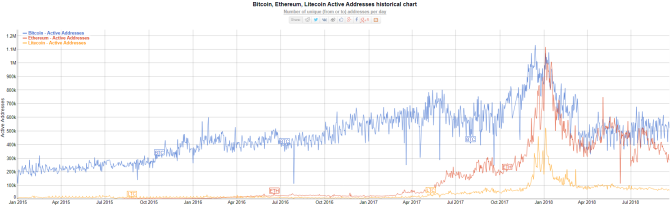

In fact, if we look at the comparative chart for Bitcoin, Ethereum, and Litecoin, we a similar story:

Chris McCann, founder of the CryptoWeekly newsletter, produced some really interesting charts illustrating cryptocurrency market and user growth in this blog post.

The two standout takeaways are that the crypto market appears to match the internet in its early days—the year 1994, to be specific. Adding to that intrigue are the similarities between the growth of crypto-assets between 2014 to 2017 and the growth in new websites between 1991 to 1995.

So, how many people own cryptocurrency? The truth is, no one knows. Higher estimates put the number at 50 million global users, while the lower bounds stick to around 10 million (which is, in my opinion, way too low given the other evidence we have).

3. More Vendors Now Accept Cryptocurrency

There’s a healthy (and growing) number of online retailers who accept cryptocurrency alongside fiat currency. Prominent examples include:

- Microsoft

- Overstock

- Newegg

- Expedia

- DISH Network

- Etsy (individual sellers)

- Intuit

- Private Internet Access

- Pure VPN

Amazon doesn’t accept cryptocurrencies as yet, but you can use Purse to locate people who are willing to use their Amazon gift cards in exchange for your cryptocurrency. You can even grab a healthy discount on your items this way.

4. Blockchain Is Safe and Secure

A few months back, I sent several hundred euro from the UK to a friend in Spain. The payment got lost in the banking system for nearly two weeks. Neither bank could find the transfer until it “popped” back into existence. During that time, it was as if the money never existed, or had decided to slip into the void.

You have to have trust in the banking system because it’s dominant—but banks regularly lose accounts, payments, transfers, and much more. Furthermore, as we see all too frequently, for all their security audits and regulations, banks are still susceptible to massive hacks.

On the other hand, no one has hacked the Bitcoin blockchain (at least since the very early days, when there was a value overflow hack that created 180 billion Bitcoins, but the developers initiated a soft fork to counteract the hack).

The lack of a blockchain hack has even been turned into a joke bounty of sorts, as the first person to hack the blockchain to execute Bitcoin transactions via any address will become an instant billionaire (presuming Bitcoin keeps some of its value after such an attack). Ultimately, until quantum computers can break a blockchain’s encryption, it remains safe from hacks.

5. Bitcoin Wallets Are Private

Your Bitcoin belongs to you. You keep it in a wallet and store it offline (I hope!). Other crypto-users can’t compel you to part with it, nor can Bitcoin or other blockchain developers force it from your wallet. Unfortunately, quite the opposite is true of fiat currency, especially when kept “secure” in a bank account.

Similarly, creating and monitoring bank accounts is tiresome, requires paperwork, and exposes your financial situation to others. You can have as many crypto-wallets as you want, each with different settings, containing different cryptocurrencies, and—best of all—each one instantly accessible from wherever you are in the world.

When Will Cryptocurrency Replace Fiat Currency?

No one knows. Probably not any time soon, though.

Until it does, cryptocurrency will exist alongside fiat currency as an alternative payment method for an ever-expanding range of goods and services. Financial institutions and governments are already exploring cryptocurrency and blockchain applications, and it’s no surprise why.

If there is going to be a global financial system shakeup, your government wants to be leading the revolution. Want to join in on the fun? See our beginner’s guide to buying your first cryptocurrency.

Read the full article: What Makes Cryptocurrency Better Than Cash or Credit?

Read Full Article

No comments:

Post a Comment