The San Francisco-based startup Branch International, which makes small personal loans in emerging markets, has raised $170 million and announced a partnership with Visa to offer virtual, pre-paid debit cards to Branch client networks in Africa, South-Asia, and Latin America.

Branch—which has 150 employees in San Francisco, Lagos, Nairobi, Mexico City and Mumbai—makes loans starting at $2 to individuals in emerging and frontier markets. The company also uses an algorithmic model to determine credit worthiness, build credit profiles, and offer liquidity via mobile phones.

“We’ll use [the money] to deepen existing business in Africa. Later this year we’ll announce high-yield savings accounts…in Africa,” says Branch co-founder and chief executive Matt Flannery.

The $170 million round from Foundation Capital and its new debit card partner, Visa, will support Branch’s international expansion, which could include Brazil and Indonesia, according to Flannery. Branch launched in Mexico and India within the last year. In Africa, it offers its services in Kenya, Nigeria, and Tanzania.

A potential Branch customer

The Branch-Visa partnership will allow individuals to obtain virtual Visa accounts with which to create accounts on Branch’s app. This gives Branch larger reach in countries such as Nigeria — Africa’s most populous with 190 million people — where cards have factored more prominently than mobile money in connecting unbanked and underbanked populations to finance.

Founded in 2015, Branch started operating in Kenya, where mobile money payment products such as Safaricom’s M-Pesa (which does not require a card or bank account to use), have scaled significantly. M-Pesa now has 25 million users, according to sector stats released by the Communications Authority of Kenya. Branch has over 3 million customers, has processed 13 million loans, and disbursed over 350 million, according to company stats.

Branch has one of the most downloaded fintech apps in Africa, per Google Play app numbers combined for Nigeria and Kenya, according to Branch CEO Matt Flannery.

Already profitable, Branch International expects to reach $100 million in revenues this year, with roughly 70 percent of that generated in Africa, according to Flannery.

In addition to Visa and Foundation Capital the $170 Series C round included participation from Branch’s existing investors Andreessen Horowitz, Trinity Ventures, Formation 8, the IFC, CreditEase, and Victory Park, while adding new investors Greenspring, Foxhaven, and B Capital.

Branch last raised $70 million in 2018. The company’s overall VC haul and $100 million revenue peg register as pretty big numbers for a startup focused primarily on Africa. Pan-African e-commerce startup Jumia, who also announced its NYSE IPO last month, generated $140 million in revenue (without profitability) in 2018.

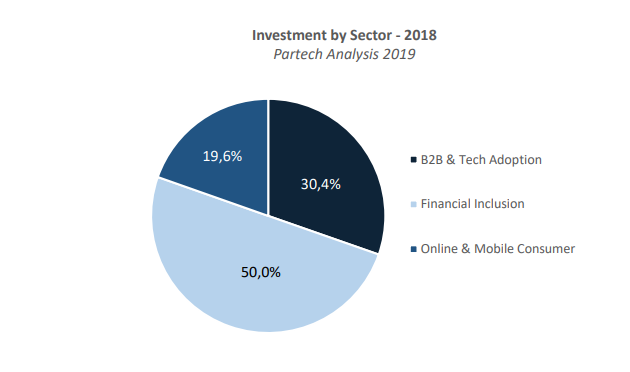

Startups building financial technologies for Africa’s 1.2 billion population have gained the attention of investors. As a sector, fintech (or financial inclusion) attracted 50 percent of the estimated $1.1 billion funding to African startups in 2018, according to Partech

Startups building financial technologies for Africa’s 1.2 billion population have gained the attention of investors. As a sector, fintech (or financial inclusion) attracted 50 percent of the estimated $1.1 billion funding to African startups in 2018, according to Partech

Branch’s recent round and plans to add countries internationally also tracks a trend of fintech related products growing in Africa, then expanding outward. This includes M-Pesa, which generated big numbers in Kenya before operating in 10 countries around the world. Nigerian payments startup Paga announced its pending expansion in Asia and Mexico late last year. And payment services, such as Kenya’s SimbaPay, have also connected to global networks like China’s WeChat.

Read Full Article

No comments:

Post a Comment