PayPal is the top dog when it comes to online payment services, processing over $150 billion worth of payments per quarter. It’s generally easy to use and a secure way to send money while buying products and services online, but it does have its downsides.

Fortunately, there are several online and mobile payment alternatives available to businesses and consumers. Below you can read some of the best PayPal alternatives for taking payments and sending money to your friends and family.

PayPal Alternatives for Businesses

One of the biggest questions regards PayPal alternatives for businesses. What services can a business use to use online and mobile payments instead of PayPal? There are several options available that businesses of all sizes can use.

![amazon pay example on site]()

Amazon’s payment service first hit consumers in 2007. Since then, Amazon Pay has taken several different guises, including the now-defunct WebPay service. Not heard of WebPay? It was Amazon’s answer to PayPal, but it ceased operation in October 2014.

Amazon Pay is a great payment acceptance option for online services for a few reasons. If you’re already using Amazon, there’s a good chance the online marketplace holds your existing credit or debit card details, speeding up the checkout process.

Furthermore, you can use Amazon Pay to login and make purchases on heaps of sites using the Login and Pay service. The same service also provides additional protection for consumers, as well as those vendors using the service.

Although Amazon Pay no longer offers a personal payment service (e.g., person to person), the security found in the Login and Pay service makes it an excellent choice. Vendors will also find Amazon Pay a strong partner to help grow their business.

![2checkout]()

2Checkout is a payment processor that acts as a middleman between you and the payer. You can accept credit cards, debit cards, and even PayPal as a payment option. There is also the option to accept payment in over 80 currencies.

2Checkout adds a management layer to your online payment processing. Vendors can create weekly or monthly payment plans through the recurring billing option. There is an extensive backend with add ons and extensions, while the 2Checkout management panel contains a wealth of user and payment data to help you manage your payment processing.

The ease of use regarding international payments makes 2Checkout a worthwhile option for many businesses. It does have some drawbacks, however.

For example, if someone makes a chargeback, it’s going to cost you $20. The standard transaction processing fee is 3.5% + $0.35 domestically, but 2Checkout slaps another 1% for customers outside the US.

![stripe payment portal example]()

Stripe is one of the most popular PayPal alternatives for accepting payments online. There are many services that prefer Stripe payments over PayPal and for a good reason. It is also one of the easiest payment options if you’re setting up an online store.

Stripe handles a huge amount of the incoming online payment process, with a very fair fee structure to boot. You can collect online payments using a variety of payment methods, and Stripe moves the incoming payments to your bank account automatically. You also have access to an extensive payment processing backend, full of data to help you analyze your sales.

There are no hidden fees or changing payment fee brackets with Stripe. Each transaction has a 2.9% + $0.30 fee per successful charge, but there are no monthly fees or deductions. Your money can take a few days to arrive, however, which is a definite downside to Stripe. Furthermore, payments from an international card will incur an additional 1% transaction fee.

4. Traditional Merchant Account

Having a merchant account from a bank gives you the ability to accept credit cards directly. There is often a monthly fee, and you must be compliant with PCI Council security standards. However, if you do a lot of business and need to integrate a payment solution into your shopping cart or system, this is the best way to go.

Ask your local bank about merchant accounts or do some research to see if there’s an online solution that fits your needs. Make sure to find a reputable provider that doesn’t have a record of poor customer service, too.

If you’re not going to be doing a significant volume of online business, though, or you’re content with using another service to process your payments, don’t worry about getting a merchant account.

PayPal Alternatives for Friends and Family

These PayPal alternatives let you send money to your friends and family directly. Some services cross-over with the PayPal alternatives for businesses, without a doubt. However, if you want to send money without worry, check out these PayPal alternatives.

![googlepay]()

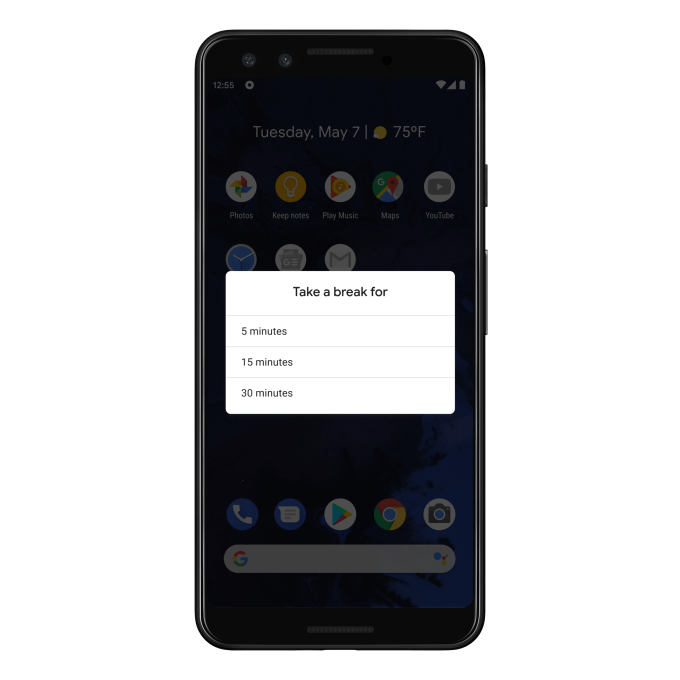

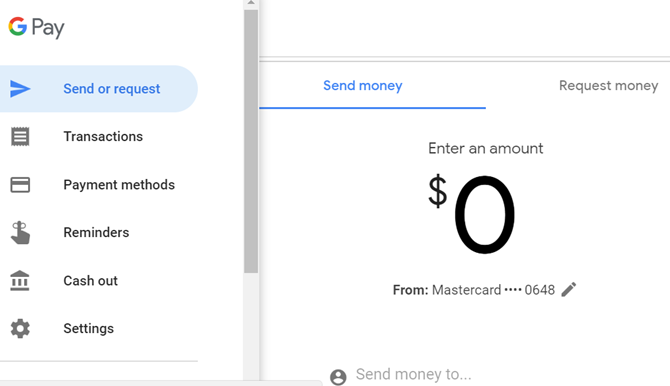

Google Pay, formerly known as Android Pay and Google Wallet, is Google’s mobile payment processing option.

As you might judge from the names, Google’s payment app has come through several iterations. At one time, you could use the Google Pay predecessor as a tap-to-pay and a peer-to-peer (P2P) payment app. Then, Google decided that you could only use the service as a P2P payment tool.

In its current iteration, Google Pay is an all-in-one mobile payment system. You can use it to make payments to your friends, at the local bar, your supermarket shop, and so on. The Google Pay digital wallet stores debit, credit, and loyalty cards, letting you make payment using your smartphone’s NFC chip.

Google Pay focuses on making mobile payments easy. “But Gavin, don’t all payment services do that?” Sure, they do. But Google Pay allows you send money to anyone with an email address or phone number, even if they’re not a Google Pay user. The recipient can instantly cash out to a bank account or debit card, granting almost instant access to your money.

Similar functionality is now also available to Gmail users, too.

Download: Gmail for Android | iOS (Free)

Download: Google Pay for Android | iOS (Free)

![apple pay ios example]()

Apple beat Google to mobile payments, as Apple Pay hit iPhones around the world back in 2014. Since then, Apple Pay has gone from strength to strength and at the time of writing has nearly 400 million users. Apple Pay isn’t limited to just iPhones. You can use Apple Pay from your iPad or Apple Watch, too.

Apple Pay allows you to upload credit, debit, and store loyalty cards for use with NFC payment terminals. It also makes it extremely easy to pay your friends and family for your share of the bill, or to send your kids a few bucks in a time of need. One downside, at least in comparison to Google Pay, is that your payment recipient must also use Apple Pay to access money sent to them.

You can still send someone money, even if they do not have the Apple Pay app installed. But to access and cash out their money to a debit card or otherwise, they must install Apple Pay.

![]()

WeChat Pay is a digital wallet and payment service available to WeChat users. WeChat is one of the biggest messaging services in the world. Every WeChat user has the option to use WeChat Pay. The sheer number of WeChat users—over 1.1 billion at the time of writing—means that WeChat Pay registers a huge number of users.

Although China has the highest number of WeChat users, the app has grown in popularity around the globe. The growth is in part due to Chinese users in different countries introducing the app to other people.

However, that belies the role of WeChat owner Tencent, the Chinese tech behemoth. Tencent owns and operates hundreds of companies. As such, WeChat has seen integrations with other Tencent services, including social media sites and gaming platforms.

Download: WeChat for Android | iOS (Free)

4. Facebook Messenger Payments

Some people will have misgivings about trusting Facebook with any form of payment information. After all, the social media giant has a terrible privacy record. Still, integrated Facebook Messenger Payments are extremely handy for a couple of reasons.

First up, Facebook Messenger Payments are super easy to use. Find your friend in the Messenger app, select Pay, and add the amount. Second, you can send and receive money from your friends and family without incurring any fees.

Finally, there is a strong chance your friend already has a Facebook account. Sending them money through the app requires no additional tools, keeping the whole payment process quick and simple.

Download: Facebook Messenger for Android | iOS (Free)

What Is the Best PayPal Alternative for Online Payments?

If you need to send money between your friends and family, choose one of the four options above. Apple users may prefer Apple Pay, especially as it integrates so well with Apple and iOS products. However, those with Android (and iOS!) devices should consider Google Pay, which offers a similar service without Apple’s restrictions.

Do you regularly make payments from a mobile app, like Google Pay or Apple Pay? If so, you should check out which NFC payment app is the most secure.

Read the full article: The 8 Best PayPal Alternatives for Making Online Payments

Read Full Article

To that end, PalmPay conveniently entered a strategic partnership with its lead investor. The startup’s payment app will come pre-installed on Transsion’s mobile device brands, such as Tecno, in Africa — for an estimated reach of 20 million phones in 2020.

To that end, PalmPay conveniently entered a strategic partnership with its lead investor. The startup’s payment app will come pre-installed on Transsion’s mobile device brands, such as Tecno, in Africa — for an estimated reach of 20 million phones in 2020.