Even the world’s second largest smartphone market isn’t immune to Covid-19.

Smartphone shipments in India fell 48% in the second quarter compared with the same period a year ago, the most drastic drop one of the rare growing markets has seen in a decade, research firm Canalys reported Friday evening.

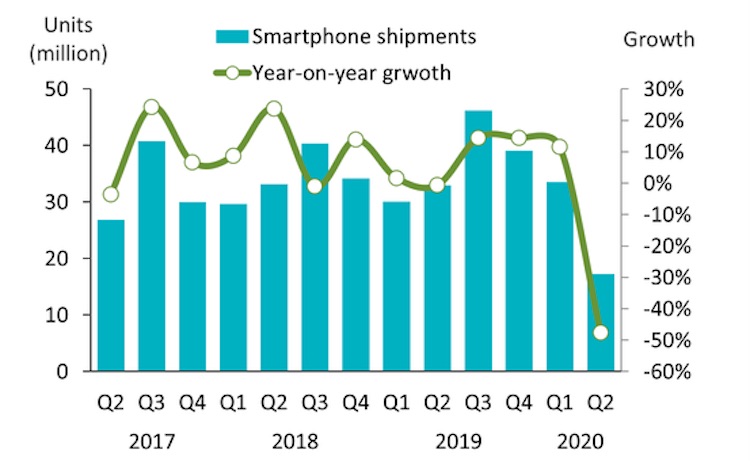

About 17.3 million smartphone units shipped in Q2 2020, down from 33 million in Q2 2019, and 33.5 million in Q1 2020, the research firm said.

You can blame coronavirus for it.

New Delhi ordered a nationwide lockdown in late March to contain the spread of the virus that saw all shops across the country — save for some of those that sell grocery items and pharmacies — temporarily cease operation. Even e-commerce giants such as Amazon and Flipkart were prohibited from selling smartphones and other items classified as “non-essential” by the government.

The protracted lockdown lasted until mid-May after which the Indian government deemed that other stores and e-commerce deliveries could resume their services in much of country. New Delhi’s stringent measure explains why India’s smartphone market dipped so heavily.

China, the world’s largest smartphone market, in comparison saw only an 18% drop in shipments in the quarter that ended in March — the period when the country was most impacted by the virus. In Q1, when India was largely not impacted by the virus, smartphone shipments grew by 4% in the country. (Globally, smartphone shipments shrank by 13% in Q1 — a figure that is projected to only slightly improve to a 12% decline this year.)

“It’s been a rocky road to recovery for the smartphone market in India,” said Madhumita Chaudhary, an analyst at Canalys. “While vendors witnessed a crest in sales as soon as markets opened, production facilities struggled with staffing shortages on top of new regulations around manufacturing, resulting in lower production output.”

Smartphone shipment estimates for the Indian market through Q1 2019 to Q1 2020 (Canalys)

Despite the lockdown, Xiaomi maintained its dominance in India. The Chinese smartphone vendor, which has been the top smartphone vendor in India since late 2018, shipped 5.3 million smartphone units in the quarter that ended in June this year and commanded 30.9% of the local market, Canalys estimated.

With 3.7 million units shipment and 21.3% market share in India, Vivo retained the second spot. Samsung, which once ruled the Indian smartphone market and has made major investments in the country in recent months, settled for the third spot with 16.8% share.

Nearly every smartphone vendor has launched new handsets in India in recent weeks as they look to recover from the downtime and several more new smartphone launches are planned in the next one month.

But for some of these players the virus is not the only obstacle.

Anti-China sentiment has been gaining mindshare in India in recent months ever since more than 20 Indian soldiers were killed in a military clash in the Himalayas in June. “Boycott China” — and variations of it — has been trending on Twitter in India as a number of people posted videos destroying Chinese-made smartphones, TVs and other products. Late last month, India also banned 59 apps and services developed by Chinese firms.

Xiaomi, Vivo, Oppo, which now assumes the fourth spot in India, and other Chinese smartphone vendors command nearly 80% of the smartphone market in India.

Canalys’ Chaudhary, however, believes that these smartphone firms will be able to largely avoid the backlash as “alternatives by Samsung, Nokia, or even Apple are hardly price-competitive.”

Apple, which commands only 1% of the Indian smartphone market, was the least impacted among the top 10 vendors as iPhone shipments fell just 20% year-on-year to over 250,000 in Q2 2020, Canalys said.

Read Full Article

No comments:

Post a Comment