Google said today it is bringing its mobile payments app — Google Pay — to businesses in India as the Android-maker rushes to maintain its payments lead in one of its key overseas markets before its global rival Facebook sets off a similar play in the nation.

Even as more than 400 million users in India are online today, most businesses in the nation remain unconnected, Google executives said at their annual event in New Delhi. Google, which has previously launched a handful of tools in India to help businesses build some presence on the web, is having another crack at it.

“India has more than 60 million small and medium-sized businesses, however only a fraction of them support digital payments. Imagine the transformation that is possible if more of these merchants could access payments online,” said Ambarish Kenghe, director and product manager for Google Pay.

One of the big challenges that is preventing these businesses to support online payments is the tedious process that is currently required for them to on-board a digital payments solution. “An agent is supposed to come to your shop and then they do the verification for you,” he said. Google has figured out a better way to address this challenge.

Google Pay for Business

The company today unveiled Google Pay for Business, a standalone app that will enable businesses to accept online payments without having to deal with an agent. “Merchants will now be able to support digital payments at their own convenience through a remote video process within minutes,” he said.

The company also unveiled a software platform called Spot that will allow businesses to easily create their own branded commercial fronts that will be accessible to customers through Google Pay app. So for instance, if a restaurant has built its store front, users will now be able to see their offerings in the Google Pay app itself. The company said several businesses in India like UrbanClap, Goibibo, MakeMyTrip, RedBus and Eat.Fit are already making use of this feature.

“We hope these initiatives will help merchants adopt digital payments with more confidence, and help contribute the long-term growth of online financial services for the benefit of every Indian,” said Kenghe.

The company has also developed Spot codes, which are like QR codes, that a business could use to allow people in its store to quickly scan and pick the items from the store they wish to order and pay for it. “A customer can come back later and pick up their orders without waiting in long lines,” explained Arjita Madan, a product manager at Google.

Jobs discovery

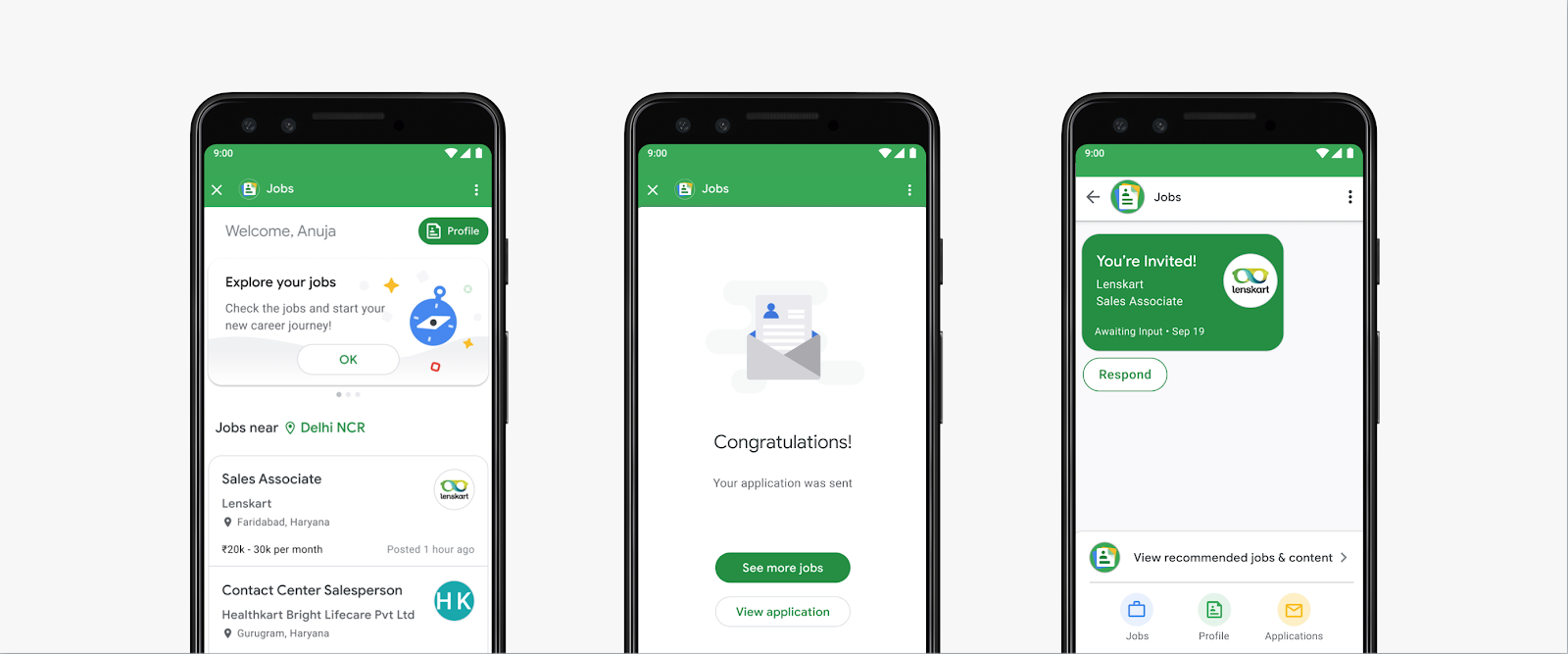

The company is also bringing a feature that will enable users to discover entry-level and white-collar jobs through the Google Pay app. “Jobs will be available as a Spot on Google Pay to help job seekers find and prepare for entry-level positions that fit their needs,” said Caesar Sengupta (pictured above), VP of Next Billion Users Initiative and Payments at Google.

He said Google is using machine learning to better understand its users, so that it recommends the right kind of jobs to them. A user only needs to provide two sets of information to get started with the feature: What kind of job are they looking for? And, how soon they want to land the job.

About two dozen companies, including Swiggy, Zomato, Dunzo in delivery and logistics and 24Seven and Healthkart in retail are early partners of Google to use Pay’s jobs discovery feature, the Mountain View giant said.

India’s digital payments market

Google launched its payments app Google Pay (called Tez then) in 2017. Pay is built on top of Indian government-backed UPI payments infrastructure and rivals Flipkart’s PhonePe app for the tentpole position. The company said today Google Pay has amassed 67 million monthly active users in India and has processed transactions worth $110 billion in the last year.

The payments market in India — which is projected to be worth $1 trillion by 2023, according to Credit Suisse — is becoming aggressively crowded and competitive. Google today competes with PhonePe, Amazon Pay and Paytm, the country’s most popular mobile wallet app, whose parent company has raised more than $2.3 billion from investors.

Google also announced that it is bringing tokenized cards for debit and credit cardholders in India, which will allow them to pay for things using a digital token instead of their actual card number. The company said it will roll out the feature to Google Pay users in the coming weeks, starting with Visa cards for HDFC, Axis, Kotak and Standard Chartered banks. The feature also will support Mastercard and Rupay at a later stage.

The addition of new features is crucial for Google Pay, which prior to today’s announcements did not have many differentiating elements. It is also racing against time as Facebook’s WhatsApp, which has over 400 million users in India, is set to expand its UPI-based payments service to all its users by the end of the year.

In the meantime, Paytm is working to expand its reach in the nation, too. The company, which posted a yearly loss of over $500 million last year, said earlier this month it intends to invest another $3 billion into its business in the next two years.

Read Full Article

No comments:

Post a Comment