ZenGo is expanding beyond the basic features of a cryptocurrency wallet — letting you hold, send and receive crypto assets. You can now set aside some of your crypto assets to earn interests. In other words, ZenGo now also acts like a savings account.

The company has partnered with two DeFi projects for the new feature. DeFi means “decentralized finance”, and it has been a hot trend in the cryptocurrency space. DeFi projects are the blockchain equivalent of traditional financial products. For instance, you can lend and borrow money, invest in derivative assets and more.

If you want to learn more about DeFi, here’s an article I wrote on the subject:

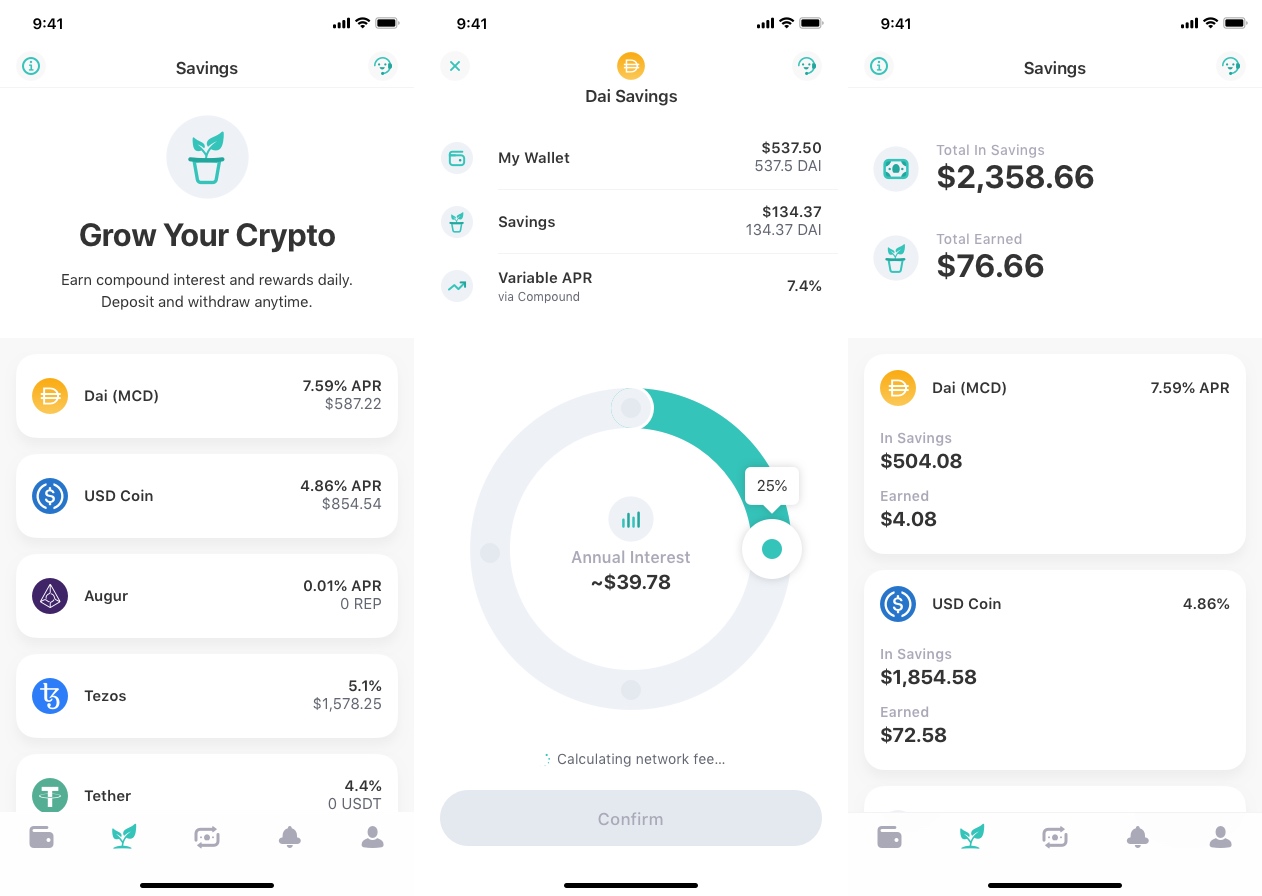

But let’s come back to ZenGo. When you have crypto assets in your ZenGo wallet, you can now open the savings tab, pick an asset, such as Dai, and select what percentage of your holdings you want to set aside.

After that, all you have to do is wait. You get an overview of your savings “accounts” at any time. This way, you can see your total earned interests. Interests are automatically reinvested over time. You can move your money from those DeFi projects back to your wallet whenever you want.

Behind the scene, ZenGo uses the Compound protocol, a lending DeFi project. It works a bit like LendingClub, but on the blockchain. Some users send money to Compound to contribute to liquidity pools. Other users borrow money from that pool.

Interest rates go up and down depending on supply and demand. That’s why you currently earn more interests when you inject DAI or USD Coin in Compound. But that could change over time.

ZenGo also uses Figment in order to stake Tezos. This time, it isn’t a lending marketplace. When you lock some money in a staking project, it means that you support the operations of a particular blockchain. Few blockchains support staking as they need to be based on proof-of-stake.

For the end user, it looks like a savings account whether you’re relying on Compound or Figment. There are other wallet apps that let you access DeFi projects, such as Coinbase Wallet and Argent. But ZenGo thinks they’re still too complicated for regular users.

Read Full Article

No comments:

Post a Comment