If you own any cryptocurrency, you’ll need to adapt to a new way of keeping your money safe. You can’t just keep your Bitcoins under the bed or deposit your Ether in a bank (at least, not yet). So what are you supposed to do?

Here are 10 common security mistakes people make when handling and storing cryptocurrency.

Mistake 1: Failing to Back Up Wallet Keys

Cryptocurrencies don’t come with online banking and password resets. Instead, you have a set of private keys that allow you to access the funds in your various wallets.

You are solely responsible for keeping your keys safe. If you lose your only copy—perhaps because someone stole your laptop—you will be locked out of your currency forever.

You should make physical copies of your private keys and store them somewhere safe from fire, water, and other damage.

Mistake 2: Not Using 2FA on Crypto Exchanges

Yes, we know, 2FA is annoying. And if I’m being perfectly honest, I don’t use it myself on services like Facebook and Outlook. For me, it’s more hassle than its worth.

But crypto exchanges are another matter. Given their poor track record when it comes to hacks, you need to take every measure possible to keep your account secure, especially since real money is on the line.

Mistake 3: Blind Loyalty to One Crypto Exchange

The dubious history of insecurity in crypto exchanges means it’s prudent to spread your risk around multiple companies. There are lots of great crypto exchanges you can use, so why stick all of your eggs in one basket?

Not only is it sound advice from an investment standpoint (different exchanges provide access to different altcoins), but it also means you’ll have less exposure in case the exchange is hacked, becomes insolvent, or faces some other disaster.

Note: You should never store lots of crypto in an exchange! See Mistake 5 for more on that.

Mistake 4: Not Verifying Your Exchange Identity

The Patriot Act of 2001 made it a legal requirement for all banks to undergo Know Your Customer verification—and the laws also apply to crypto exchanges in the US. Even non-American exchanges now undertake the process in order to comply with US law for their American clients.

But here’s the catch: some crypto exchanges let you deposit funds and start trading without completing the verification process. They will not, however, allow you to withdraw money until you are verified. Obviously, the verification process also helps prevent fraud from happening on your account.

So, if you want to make sure your crypto assets are available when you need them, make sure you’ve completed the necessary verification steps on your exchanges of choice.

Mistake 5: Storing Cryptocurrency in Hot Wallets

Hot wallets are crypto wallets that are accessible over the internet—and it’s that connectivity that opens them up to considerable risk. We’ve already mentioned exchange hacks, but you’re also at the whim of forced government shutdowns and some of the other pressing issues facing blockchains.

Instead, you should keep as little money in hot wallets as possible. Obviously if you’re going to day trade or swing trade crypto, you’ll need some amount of liquidity. But generally speaking, crypto should be stored in cold wallets for maximum security. We’ve recommended some secure cold wallets to check out if you’re not sure where to start.

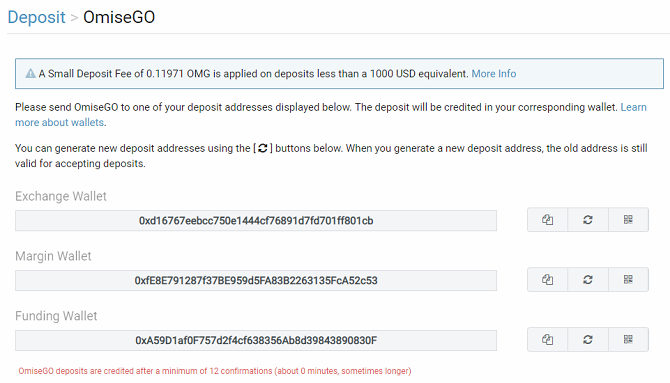

Mistake 6: Sending Crypto to the Wrong Wallet

It’s easy to suffer from wallet overload. You have public keys for your exchanges, for your offline storage, and for all the different coins you own. With so much going on, it’s easy to accidentally send coins to the wrong wallet.

If the crypto you send is not compatible with the wallet you’re sending it to (for example, if you send Bitcoin to an Ethereum wallet), there’s a strong possibility that you’ll irrevocably lose your assets.

Mistake 7: Using Public Wi-Fi Networks

You should never use a public Wi-Fi network (in a school, hotel, airport, or coffee shop) to perform cryptocurrency transactions.

The security flaws in public networks are well-documented. There are lots of ways hackers can use them to steal your data. You need to ensure that you don’t inadvertently reveal your private keys or exchange passwords to a snooper.

Check out MakeUseOf’s article on how to stay safe while using public Wi-Fi to learn more.

Mistake 8: Using Insecure Browser Extensions

As you might be realizing from reading this article, most cryptocurrency security mistakes arise from leaving yourself exposed to an excessive number of vulnerabilities.

One of the most oft-overlooked security vulnerabilities is browser extensions. Some of the extensions have a shockingly large number of permissions. Can you really trust them?

At the very least, you shouldn’t perform crypto transactions using a browser on which you’ve installed untrusted plugins and extensions (such as ones you sideloaded manually). Ideally, you should use one of the best privacy-friendly browsers and use it exclusively for crypto payments.

Mistake 9: Using Weak Passwords

This is an obvious tip, but it’s imperative to make sure you use secure passwords on your exchange accounts. If you have not implemented 2FA, it’s the only barrier between your funds and cybercriminals who want to brute force your credentials.

Remember, crypto exchanges and other hot wallets don’t give you a security token like a bank, and there are no industry-wide rules for refunds or recourse in the event that you’re the victim of a theft.

To make sure you don’t forget your hard-to-remember secure passwords, use a password manager like LastPass.

Mistake 10: Falling for Crypto Scams

One of the most important ways to keep your assets safe—whether it’s fiat money or cryptocurrency—is to steer clear of scams, frauds, and the other ways people try to con you out of your capital.

1ST ROUND OF ICO TO END IN 2 HRS!!!

TO INVEST,

SEND:

0.01 ETH = 2,000,000 NPAT

0.03 ETH = 6,000,000 NPAT

0.05 ETH = 13,000,000 NPAT

0.1 ETH = 40,000,000 NPAT

0.3 ETH = 150,000,000 NPATSEND ETH: 0x17683f28d0290884df8a28b36ceeea6cdf169f65 #ico

— nanoPay (@NanopAy_tokens) September 12, 2018

Sadly, scams are common in the world of crypto. For example, you need to perform no more than a cursory search on Twitter to find people offering to send you 50 ETH seven days from now if you send them 10 ETH today.

Like anything in life, if something sounds too good to be true, it probably is. Exercise the same caution and common sense that you would with any other financial asset.

Of course, keeping your cryptocurrency safe when it’s under your control is just one part of the security puzzle. You also need to have a thorough grasp of how secure Bitcoin transactions are and other crypto threats facing your coins.

Read the full article: How to Keep Your Cryptocurrency Safe: 10 Common Mistakes to Avoid

Read Full Article

No comments:

Post a Comment